The semiconductor industry has been getting ready for In-Mold Electronics (IME) since 2007 or so. The transformative technology got off to a false start with an overhead Ford console in 2012, which wasn’t the commercial coup anticipated because it gave false readouts. The console’s failure is commonly attributed to the rush to get the product to market.

But IME is on its way to becoming a well-established process with a well-developed ecosystem and a mature, easy-to-use design-to-product workflow, and will become the basis of many novel structural electronic designs and products. A recent IDTechEx report, In-Mold Electronics 2019-2029: Technology, Market Forecasts, Players, looks at IME and associated technologies such as inks, pick-and-place, and printing.

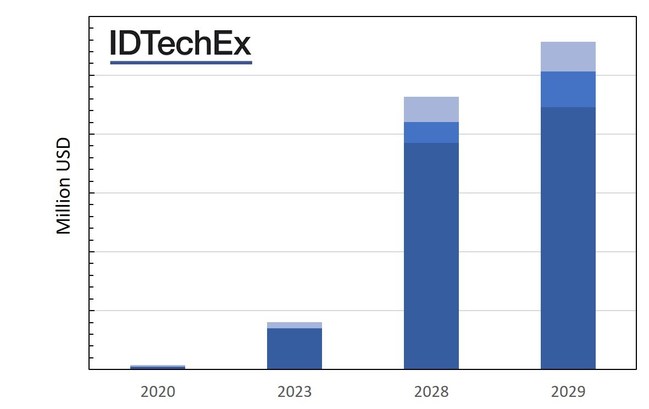

Categories include automotive, white goods, and other, which includes consumer electronic applications.

IME eliminates the board and structurally integrates the wiring and optical guides, saving space and enabling novel, thin, and light-weight 3D-shaped designs. There are markets in consumer, white goods, and automotive interiors and exteriors. In the long term, IDTechEx believes that the market will grow to exceed $1B by 2029 despite the slow take-off.

Conductive inks have been developed to withstand elongation, to adhere to PC or similar substrates, to match with other stack materials, and to survive the molding and in-field operational conditions. Special adhesives are being formulated to also withstand the process and operational conditions. Thin optical guides to spread the light have been demonstrated, opening new design features and allowing user feedback. Crucially, the ecosystem has accumulated know-how as it has spent years learning about the best design rules, the appropriate material stack, the optimized curing, forming and molding conditions, the matching IC package specs, and so on. Despite this, there is more to learn for scale-up high-yield production with long product lifetime, which is required in the absence of post-deployment repair opportunities.

The ecosystem is also coming together. Material suppliers have been very active, engaging early in the technology development cycle and pushing their formulation capabilities. The processing houses and contract manufacturers were slower to jump on board. This is now changing, though. Some IMD companies have installed IME equipment. Some membrane switch and similar firms have extended the equipment set. Some have invested in lines to service the automotive market from 2022 onwards. In automotive, tier ones and OEMs have engaged, developing many prototypes, some of which are now progressing through qualification.

Automotive is a major addressable market, both exteriors and interiors. The market deployment is likely to start with simpler products like heaters embedded in light covers to accelerate defrosting when energy-saving LED lights are employed. These are already available for purchase as retrofits. Transparent foils printed with fine metal mesh and conductive lines are conformed to a 3D shape to create an HVAC control panel for automotive interiors. This process is very similar to a classic IME. Yet another interesting example is the use of carbon nanostructure (carbon nanobuds) to create 3D-shaped uniform transparent heaters for use in ADAS and autonomous driving perception sensors such as cameras or LIDARs. Another example is in a wearable/consumer product in which a simpler interconnect is molded.

Recently, a remote door lock switch was announced using IME. In general, the first generation of products to have reached the market, or to have come very close, represents simpler manifestations of IME. Of course, in terms of prototypes, complex systems incorporating multiple LEDs, light guides, many touch switches or slides, NFC antennas, etc. are demonstrated. These show the future development direction.

Overall, the market is beginning to change character towards product production. IDTechEx expects the market to show accelerated growth from 2023/2024 onwards, starting from simpler small-area devices then progressing towards more complex larger-area and higher-volume applications with more stringent reliability requirements.

Source: IDTechEx