Rare earth elements are not necessarily rare but are precious and difficult and expensive to mine and separate. Essential to many emerging technologies, they are often classified by the U.S. government as being critical to national security. They are also important to such industry segments as clean energy, electronics, and medicine.

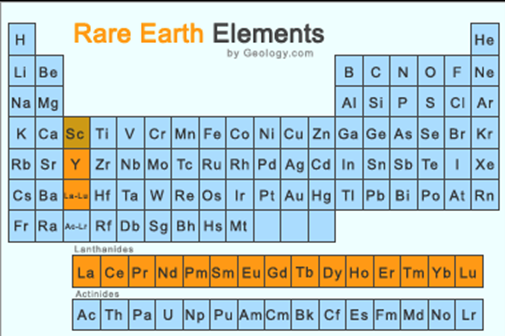

There are seventeen rare earth elements including: Scandium, Yttrium, Lanathanum, Cerium, Praseodymium, Neodymium, Promethium, Samarium, Europium, Gadolinium, Terbium, Holmium, Dysprosium, Erbium, Thulium, Ytterbium, and Lutetium (See Periodic Table above).

A Brief REE History

In Q3 2020, President Trump signed an executive order establishing a national emergency in U.S. mining geared to reestablish rare earth mineral processing and incentivizing

domestic production of rare earth minerals. Trump wanted to further reduce American dependence on China. In retrospect, he had good reason when we look at the historical timeline of rare earth elements.

- Rare earth elements (REEs) discovered and used in the U.S., production moved to China based on labor costs, less environmental concern, and the availability of large state subsidies

- In 1997, Magniquench, America’s leading REE company, was sold to a consortium headed by Archibald Cox, Jr., with two Chinese state-owned metals firms. It was then shut down in the U.S., moved to China, and reopened in 2003. (See: Magniquench: CFIUS and China’s Thirst for U.S. Defense Technology)

- Molycorp, the last remaining major U.S. REE producer closed in 2015. When China relaxed its export quotas in 2015, REE prices fell. Molycorp’s debt was $1.7 billion, and it had a half-finished processing facility it sold for $20.5 million to a consortium. China’s Leshan Shenghe Rare Earth Company has a 30 percent non-voting interest and maintains exclusive sales rights for Mountain Pass minerals and Molycorp sends its REEs to China for processing. (See: Massive Mojave Mine Molycorp to Close Taking Nearly 500 Jobs)

- In September of 2010, a Chinese fishing boat rammed two Japanese coast guard vessels in the East China Sea. The Japanese government announced it would try the fishing boat’s captain. Chinese retaliated with an embargo on rare earth sales to Japan, potentially devastating Japan’s auto industry. REEs are an integral part of catalytic converters (See: 2010 Senkaku Boat Collision Incident)

- The U.S., EU, Japan and other nations filed suit against China in the World Trade Organization, and it took four years for a ruling. China denied the embargo saying it required the REEs. China had been restricting exports, causing concern in the Pentagon about shortages of four REEs—lanthanum, cerium, europium, and gadolinium—that were causing delays in producing certain weapons. (See: Rare Earth Trade Dispute)

Globally, the top three REE producers globally (2020) are China with mine production of 140,000 MT, the U.S., producing 38,000 MT, and Myanmar producing 30,000 MT. China controls nearly all the world’s processing facilities.

Supply Chain Challenges

Supply Chain Challenges

It isn’t just cars and phones. REEs are found in more than 200 products across such applications as cellular phones, computer hard drives, electric and hybrid vehicles, flatscreen monitors and televisions and clean energy, as well as such defense apps as electronic displays, guidance systems, lasers, and radar and sonar systems.

In a new study, scientists at Argonne National Laboratory highlighted the effects of supply disruptions such as mine shutdowns. Disruptive events also include natural disasters, labor disputes, construction delays and, of course, a pandemic. In the study, published in the journal Resources, Conservation and Recycling, Argonne researchers analyzed the potential effects of three supply disruption scenarios on ten rare earth elements. To conduct the analysis, they used Argonne’s Global Critical Materials (GCMat) tool, which forecasts rare earth market dynamics by modeling decisions that individual mining projects, producers, and consumers might make.

The study found that the largest price increases in response to disruptions occurred for dysprosium oxide, used in permanent magnets, specialty alloys, and other applications. Didymium oxide, a mixture of neodymium and praseodymium, was also found to be prone to price surges.

The study also suggests supply disruptions may foster earlier and more REE mine starts outside of China, but the challenge is sustainability post disruption. Price and associated market responses such as production, capacity, and demand tended to extend beyond the disruption period. Such market impacts in the magnet supply chain could affect the costs and availability of emerging clean energy technology applications such as electric vehicles and wind turbines.

Analysis found that for the temporary scenarios of a one-year export stoppage and a two-year mine shutdown, price impact may extend years beyond the disruption period, as could production, capacity and demand potentially last longer. Most important, the results suggest that some mines that started up outside of China in response to a disruption would most likely not be able to continue operations after primary supplies are recovered—which sounds like a repeat of the history earlier noted.

We can find similarities between the recent semiconductor shortages that disrupted global supply chains and potential rare-earth shortages. A shortage of rare earth magnets will seriously disrupt wind turbine and electric vehicle battery manufacturers. Even short-term export bans or mine shutdowns will impact prices, demand, production, and capacity, potentially years beyond the actual disruption.

What is different between shortages in semiconductors and rare earth elements is that setting up mining and processing for rare earth is a much larger problem in time, potential benefit, and long-term potential success. That doesn’t mean that it isn’t on the drawing board. The industry has also been working to diversify its supply chains. Mountain Pass, for example, is working on domestic separation and processing capacities to produce high-purity rare earth oxides and USA Rare Earth is developing a mine in Texas and setting up processing and magnet making. Two North American companies are building a U.S./Europe rare earth supply chain announced earlier this year. Unfortunately, evidence exists that they have ties to China.