It was a little different back in 1997 when SARS hit. The tech industry’s reliance on critical products and components from China was, in comparison to today, minimal. Now, the COVID-19 virus is shuttering factories and shops in the Wuhan area and transportation is halting. Even as some are reopening, there is a very slow return to normal.

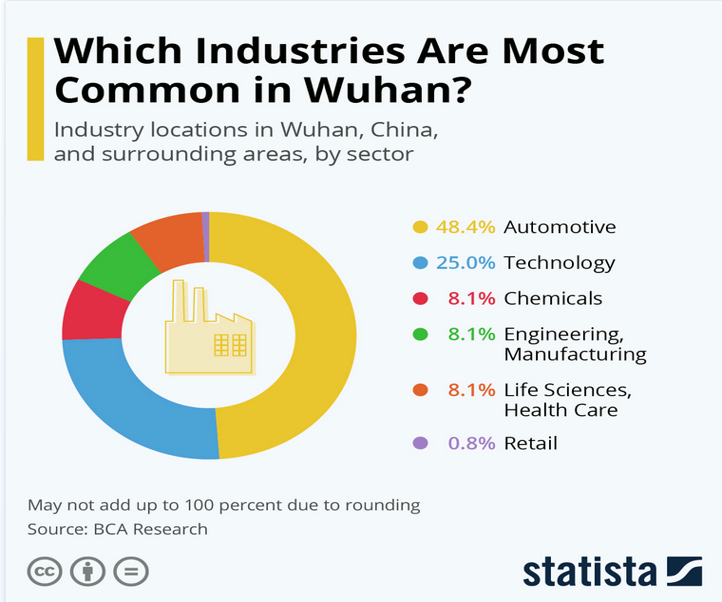

Figure 1. Reliance on Wuhan by automotive, engineering, manufacturing and technology is substantial, as is the impact of the COVID-19 epidemic. Source: Statista

A look at what has happened within the electronics area over the past few weeks:

For the industry as a whole, an immediate reaction was seen when Mobile World Congress (MWC) exhibitors pulled out of the Barcelona conference, causing a cancellation for the first time in 30 years. Approximately 200 companies will be missing from the Embedded World Conference in Nuremberg, Germany based on COVID-19 concerns. The trade show, however, still expects 900 exhibitors and it will go on as planned. These events are important for sales/marketing, customer support, and product demonstrations. It’s difficult to measure the impact of the cancellations at this time.

Chinese market researcher TrendForce, estimates a 10% hit to global smartphone production in Q1 2020. Expect that unit shipments of notebooks, smartwatches, video game consoles, and more will also suffer double-digit hits. Airbus shut down a factory in China, Hyundai idled all seven plants in South Korea for lack of parts from Chinese and Tesla closed its Shanghai factory and warned of delivery delays, according The Wall Street Journal.

Apple, with 290 of its 800 suppliers located in China, expects a production, sales, and revenue impact and that the global iPhone supply will be constrained. Although iPhone manufacturing is located out of the province worst hit by COVID-19, and all of these facilities are now open, ramp-up is slow. Samsung is likely in better shape than most since it closed its final mobile phone factory in China in October 2019. The company began moving capacity to Vietnam over the past few years, so it has benefited not only from the COVID-19 epidemic so far, but also from the U.S.-China trade-tariff war.

According to MarketWatch, the disruption in supply chains will result in unavoidable delay to introduce new products to the market, especially true for the automotive industry. Half of all manufacturing in Wuhan is automotive-related. Production is expected to be slashed approximately 15% in Q1, affecting Toyota 3.33%, Volkswagen -5.86% and General Motors -4.81%.

It isn’t just the major corporations that are feeling the pinch. According to Sandra Garby, Co-Founder and President & VP of Operations, Vizinex RFID, manufacturer of RFID tags in Bethlehem, Pennsylvania, “We have several suppliers of our main raw material in China, and all have pushed back deliveries by about 2 weeks. Plus, one of our suppliers in Taiwan pushed back a delivery by about a week because it has workers based in China, and I am told the production line of our major supplier there is only running at about 50%. There is one supplier who has yet to respond to my communication, so I am not sure if they are back at work yet or not. Because Vizinex RFID has some inventory and we generally try to build in a little cushion for our orders, this has not yet been a major problem for us. But if these deliveries get pushed out further, it will impact our deliveries to customers.”

Matt McCormick, Founder of Jet City Device Repair with facilities in Chicago and Seattle stated, “My business repairs iPhones, iPads, and Chromebooks. Almost all of the parts we need come from China. Every year, we have to deal with the Chinese New Year. It means about two weeks where we can’t order any parts from China. We’ve gotten pretty good at planning for this and, for the past several years, it’s caused very few problems. However, the timing of this year’s Coronavirus meant that normal two-week shutdown has turned into four weeks and there is still a lot of uncertainty.”

To combat this, McCormick says that the company has turned to domestic alternatives, but this comes with some challenges:

- These parts tend to be more expensive during normal ordering cycles but right now, with the industry wide shortage, they’re even more expensive.

- Domestic parts quality is usually not as reliable. So not only are we paying higher prices, we’re frequently getting a worse product.

- Our normal domestic vendors are running out of stock so we’re having to rely on unknown vendors or, worse still, random people on eBay – notoriously bad.

The inadequacy of risk management and supply chain agility is always apparent on the heels of epidemics, natural disasters and governmental challenges. Emergency planning that considers the potential impact of such scenarios and how to mitigate the risks involved is crucial.

China has already paid its dues with efficient manufacturing operations efficiency and technology advancement. It makes no sense to just abandon China because of COVID-19. There will be other disasters and pandemics. What can each company do to manage such risk, and how can each member of the supply chain introduce automation that provides enough information along the chain to be valuable?

The tech industry, from semiconductors to PCBs, across automotive and industrial applications will see shortages. It will be interesting to see how each begins to modify its business to accommodate the next disaster.

Or will they?