It’s clear that something (or a lot) needs to be done to ensure survival for automotive suppliers. They face a future of amazing growth based on the explosion in necessary EV parts. Deloitte pegs the increase to be 475% in the next five years. There is also the commodities involved with EV battery production, such as lithium and nickel.

Deloitte indicates that meeting the burgeoning demand will require suppliers to opt for strategic consolidation, acquisitions and alliances. The goal is to protect margins and diversify risk not just across the growing segments, but also the stagnant and declining ones.

Deloitte’s fifth “Global Automotive Supplier Study” examines the trends changes across virtually every arm of the complex global automotive supply chain. The report includes quantitative analysis of shareholder value performance from 300 of the top global automotive suppliers and interviews with senior automotive supplier executives.

Key findings of the study include:

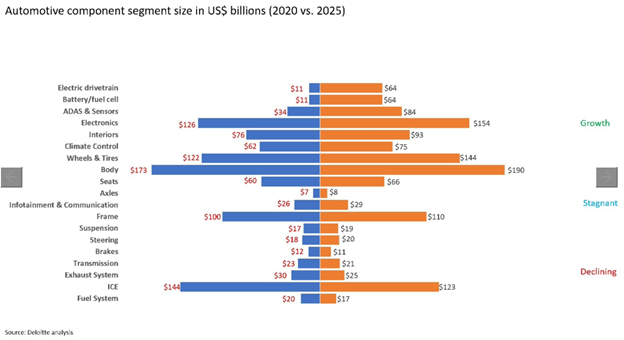

- Both electric drivetrains and battery/fuel cell segments are poised for exponential growth, each projected to increase 475% between 2020 and 2025, combining for a market size of $128 billion at the end of the forecast window.

- Additional segments positioned for growth include ADAS and sensors (150%), electronics (22%) and interiors (21%).

- Despite internal combustion engine (ICE) parts showing a 15% reduction by 2025, its market share forecast of $123 billion, along with vehicle frames ($110 billion), demonstrates the segments will remain relevant for suppliers looking to capitalize on consolidation opportunities in this space.

- ICE and hybrid powertrains will comprise 85% of total global engine production in 2025, signaling robust demand for legacy propulsion technology to the middle of the decade.

- Auto manufacturers are looking to renegotiate for longer contracts and direct partnerships with chip suppliers.

Suppliers are at a critical juncture where they need to expand or defend their current positions or pivot toward something new.

Original Release: PR Newswire