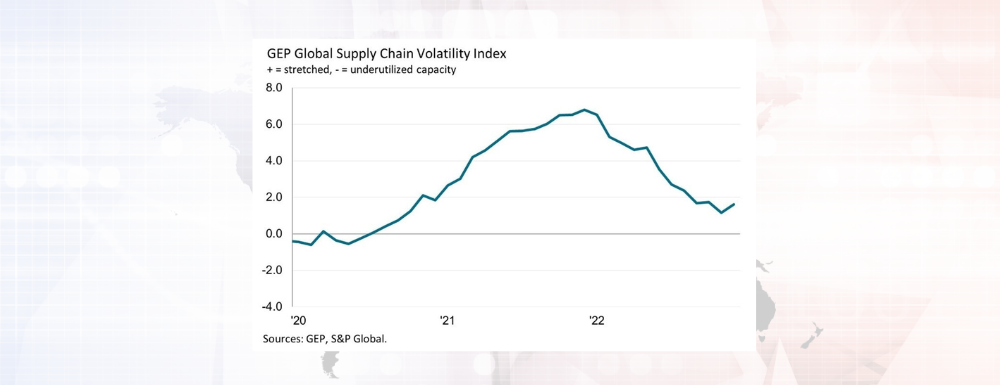

The GEP Global Supply Chain Volatility Index showed declining demand for raw materials, commodities, and other components needed to provide finished goods and services in December. That indicates a growing risk of an upcoming recessionary period. More businesses are safety-stockpiling inventories as a reaction to COVID-19 infections in China and increased concerns about future supply and pricing. This is partly reversing destocking efforts seen in the previous six months.

Greater safety stockpiling and the worsening of labor shortages caused the GEP Global Supply Chain Volatility Index to rise from 1.15 in November to 1.61 in December, halting global supply chain improvements that began in the summer of 2022.

The key findings from December’s report include:

- Demand for components, raw materials, commodities, and any other items companies need to provide their goods and services declined further in December

- Global business reports of safety stockpiling are up since November, a key factor behind December’s Index increase

- Companies report an uptick in labor shortages, causing supplier capacity to be stretched

- Global supply shortages are at their lowest level since September 2020 as suppliers continue to adjust to market conditions

- Transportation costs are at their lowest in over two years, highlighting weaker pressures on shipping, train, air and road freight

- Supply chains feeding into Europe are the most stretched, compared to Asia and North America

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP and is derived from S&P Global’s PMI surveys, sent to approximately 27000 companies in over 40 countries that account for 89% of global gross domestic product (source: World Bank World Development Indicators).