Tech companies are fighting back regarding critical minerals. Globally, countries are attempting to secure crucial mineral supply chains while investing in new exploration and production.

How critical is this? So much so that Canada forced three Chinese companies to sell their mining assets in the country. With the focus on securing these minerals, non-Chinese companies with access to these resources are becoming increasingly important.

When the Chinese companies were forced to divest, Canadian miner PowerMetals Corp controlled not only a potential high-quality lithium mine but the only functioning cesium mine in the world that China doesn’t own. Cesium is central to the U.S. 5G race, playing a pivotal role in aircraft guidance systems, oil and gas drilling, and global positioning satellites. However, all the known cesium deposits have been depleted, or the mines are inoperable. PowerMetals Corp and its Case Lake project may be one of the most unique natural resource plays in the world today.

Typically, Canada’s critical metals are found in highly remote areas. However, all the road and electrical infrastructure is already in place for the Case Lake prospect, and it even has cell phone signals. The cesium, lithium, and tantalum intersections here are in pegmatite exposed on the surface so shallow it is less than 50 meters deep in various areas.

When Chinese companies were forced out, big Australian money and expertise jumped at the opportunity to secure a potential critical minerals mine. And they have Australian cesium development expertise.

Before discovering cesium, PowerMetals was already making waves with its lithium and tantalum discoveries at Case Lake. Power Metals discovered the rare cesium at Case Lake’s West Joe Dyke while drilling for lithium and tantalum. This is some of the highest-grade cesium found in decades, with grades as high as 24% over good intervals. With the discovery, a Chinese company jumped on the opportunity and acquired 5.7% of Power Metals. Canada has hit back, and Power Metals is ready to extricate itself from China’s influence.

Other miners and minerals include:

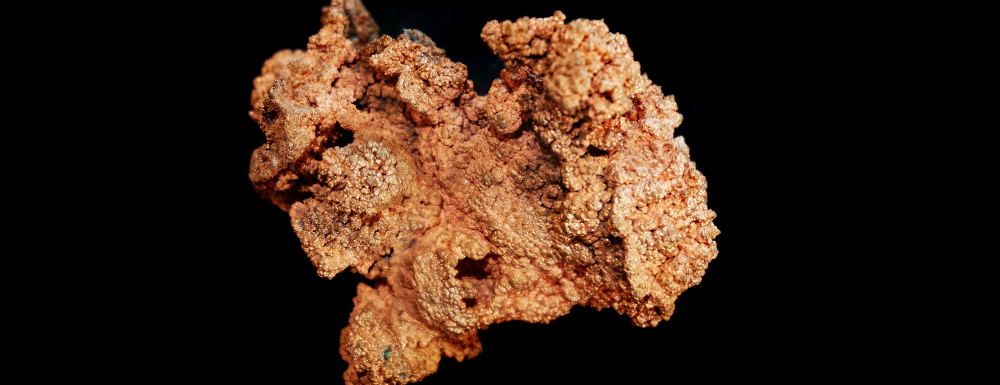

Freeport-McMoRan Inc. in Phoenix, Arizona, has an impressive array of reserves comprising copper, gold, and molybdenum. This includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits, and extensive mining operations in the Americas. Renewable energy and electric vehicle technologies use copper as a crucial material. As a significant player in copper mining, Freeport-McMoRan will gain from this trend.

Turquoise Hill Resources, a Canadian firm in Vancouver, is focused on operating and developing the Oyu Tolgoi copper-gold mine in southern Mongolia. Turquoise Hill has a 66% interest in one of the world’s largest known copper and gold deposits, with the remaining stake held by the Government of Mongolia.

FMC Corporation, located in Philadelphia, Pennsylvania, plays a significant role in the lithium market, a key component in rechargeable batteries and other high-tech applications, even though it’s not a traditional mining company.

Livent Corporation is a global leader in lithium technology and a spin-off of FMC Corporation. It supplies lithium used in batteries for hybrid and electric vehicles, mobile devices, and other consumer electronics.

Rio Tinto has considerable resources across a variety of commodities such as aluminum, copper, diamonds, coal, iron ore, and uranium. Recently, Rio Tinto has amplified its efforts within the renewable energy industry, investing in technologies designed to reduce carbon emissions and proactively participating in producing materials crucial to the renewable energy sector, including copper and lithium.